Clinical Research in Germany- A Contemporary perspective

Introduction and Overview

Germany is ranked as a leader in clinical trials conducted in Europe and ranked as among top 5 in the world. Clinical trial data quality is at par with the US, costs are up to 50 percent lower in Germany. The country’s key competitive advantage lies in the combination of lower costs for enhanced levels of expertise and quality. According to a report published by the Germany Trade & Invest, at least 45 university hospitals and 118 clinical institutes are involved in clinical trials in Germany. The Charité in Berlin is Europe’s largest university hospital. Most of the clinical trials conducted in Germany are located in the Berlin region, followed by Hamburg, Munich and the Rhine-Main area. University hospitals in these areas enjoy excellent national and international reputations. German hospitals are renowned for their consistent and reliable collection of data in clinical test series.

The conditions and infrastructure for conducting clinical trials in Germany are second to none. This is not only due to the high quality of R&D conducted at German universities, but to research institutes and the reputation of German university hospitals. The country’s population density facilitates swift recruitment of eligible participants, while the dense network of health care facilities, doctors in own practice, and universities offers optimal clinical trial conditions. Germany can boast 34 physicians and 83 hospital beds per 10,000 inhabitants.

The main focus of clinical research in Germany is on verifying the effectiveness of new molecular entities and therapies for cancer (23 percent), cardiovascular diseases (18 percent), nervous system disorders including neurodegenerative diseases such as Alzheimer’s dementia and Parkinson’s disease (15 percent), and infectious diseases (10 percent).

Pharmaceutical companies in Germany are highly engaged in clinical trials for improving medication in the fields of the most common causes of death (i.e. cardiovascular diseases and cancer) as well as in the field of geriatric disorders and Diabetes

Analysis of registered Clinical Trials in Germany

Trends in Clinical Research in Germany can be analysed from the clinical trials registered on the https://clinicaltrials.gov/ website. Greater than 10000 Clinical Trials are registered in various phases of clinical research on a regular basis in Germany. Nearly 75 % of the clinical trials are industry sponsored and the remaining belongs to sponsorship from academic or other sources. Phase II and Phase III clinical Trials contribute to nearly 67 % of the total clinical research in Germany. The top 10 companies contribute to 32% of the clinical trials in Germany.

The top 5 leading players in clinical trials in Germany are Novartis Pharmaceuticals, GlaxoSmithKline, Boehringer Ingelheim, Hoffmann-La Roche and Bayer.

Clinical trial study design of more than 50% of the registered clinical trials in Germany fall under the category of randomized, Intervention Model: Parallel Assignment, Masking, Open Label where the primary purpose is exclusively treatment.

An analysis of the top 10,000 clinical trials in Germany by Phase shows that nearly 40% of the trials are in Phase 3 followed by Phase 2 which contributes to neraly30 % of the total clinical trials.

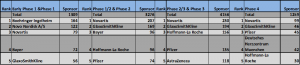

The top 10 companies in clinical trials in Germany also feature in the top 5 rank in their contribution in each of the Phases of clinical trials namely Early Phase 1 & Phase 1, Phase1 /2 and Phase 2, Phase 2 /3 & Phase 3 and Phase 4.

Novartis is the leader in the category of Phase1 /2 and Phase 2, Phase 2 /3 & Phase 3 and Phase 4 for clinical trials in Germany. Early Phase 1 / Phase 1 is the only category of Clinical trials in Germany where Novartis rank is third.

The top 10 companies have maximum number of trials in the Phase 2 and the Phase 3 which feature in the active/not recruiting participants for the trials or are in the recruiting stage. Greater than 80% of the clinical trials in Phase 2 and Phase3 trials are in the active/not recruiting stages of enrolment. Only 69 % of the clinical trials are in the recruiting phase of enrollment clinical trial market of Germany.

Greater than 2000 clinical trials in Germany by the Top 10 Pharmaceutical companies are engaged in active recruitment of Phase 2 and Phase 3 clinical trials. Greater than 200 clinical trials are available for recruitment in the Phase 1 in Germany (first in man trials). Clinical trials for molecules seeking safety studies or final approvals (Phase 4) which are in the recruiting or active recruiting stages are less than 200. Phase 4 clinical trials occupy a small number of clinical trials in Germany because many molecules fail to reach this stage because of lack of efficacy, inability to achieve the desired clinical trial end point, lack of active funds, non availability of PI, adverse events in the earlier phases, lack of availability of the desired population for the clinical trials and slow regulatory processes.